ABOUT US

Redhat Capital PLC was founded on the premise that as a management team we would be uncompromising in how we conduct business.

At the cornerstone of our business ethos is performance, integrity and transparency and we have built the group into what it is today on those foundations.

We are ambitious for our clients and deliver consistent levels of performance thanks to our exceptional team who have over two decades of experience working across international financial markets.

Strongly aligned with our performance – we operate very strong governance which is embedded at every level of our group and supported at every step by our professional counterparties and advisers.

We now operate across most major markets including indices, commodities and foreign exchange.

We continue to develop the group and our strategy will be taking our operations into both the Middle East and Asia, as we are planning to open new offices in the United Arab Emirates and Singapore during the course of this year.

Achieving Performance

Redhat’s trading philosophy encompasses a wide range of asset classes, including commodities, futures & options, indices, arbitrage and FX.

Our trading strategies are designed to deliver absolute returns in any given market conditions to deliver consistent performance. These returns are generated by applying a flexible model, which encompasses the following framework:

• An arbitrage model;

• A hedging aspect;

• An actively managed portfolio with high liquidity.

Through the management team, the Investment Committee, and traders deployed to each strategy, Redhat aims to deliver consistent returns and performance over time, therefore mitigating the long-term risks.

BOND PERFORMANCE

DELIVERING CONSISTENT 12% PER ANNUM

Corporate Governance and Risk Management

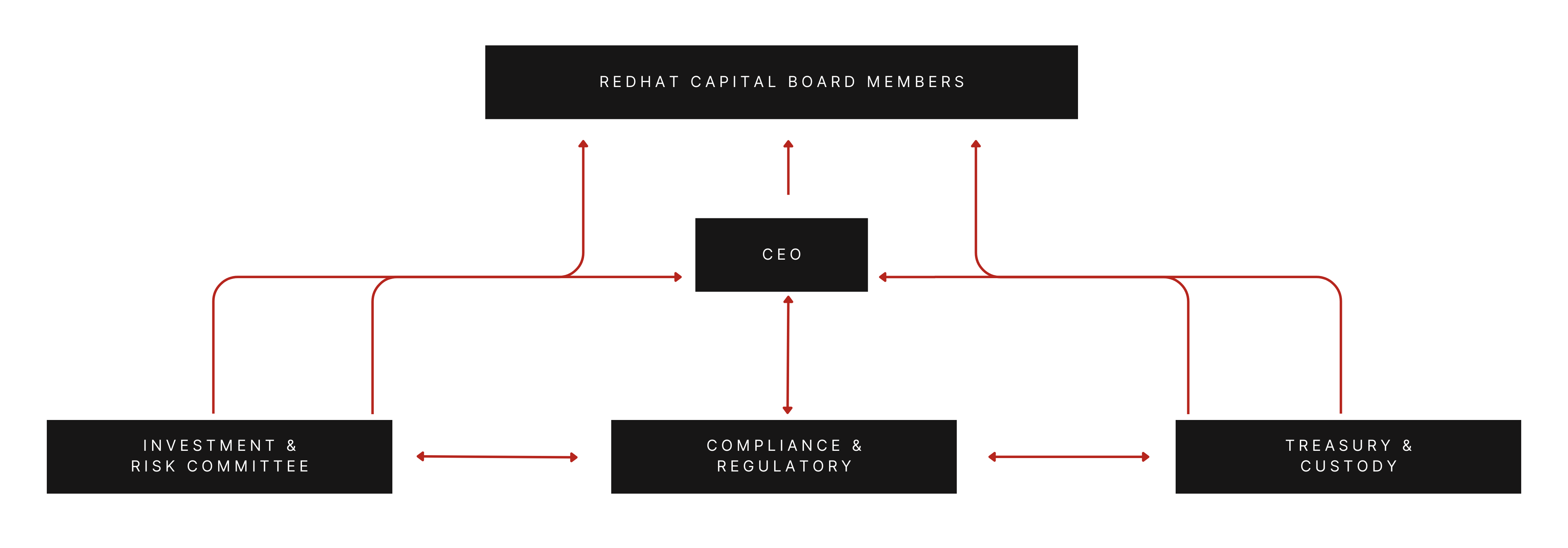

Redhat Capital Plc maintains the highest standards of corporate governance with complete transparency across all aspects of the corporate structure.

Centralised around the CEO, all divisions across the firm report to both the CEO and the Redhat Capital Board to ensure transparency and timely reporting.

The investment committee oversees all risk and investment decisions made by the company. The investment committee maintains independence from the board and CEO, having the right to only approve investment decisions that are in the best interest of both the company and its clients.

Compliance and regulatory maintains oversight across the investment committee as well as treasury & custody, ensuring the safe holding of client funds through the use of independent and regulated custodians.

A marketing and business development professional with a finance and investment sector track record spanning more than a decade, I am a founding director & CEO of Redhat Capital plc.

Having worked at Director level in the broker market, I have a 360 understanding of what introducers and high-net-worth individuals are looking for from an investment product and what they expect from an investment provider.

My goal is to leverage that knowledge and operate creatively to provide unique products that offer attractive opportunities for high-net-worth and sophisticated investors to grow their wealth while managing risk.

Mathew has over 15 years senior experience in the financial services sector across a variety of FCA regulated roles with CF30 accreditation.

Throughout his career, he has developed an extensive network of high net worth clients and contacts, for which he has developed a broad range of investment opportunities across different sectors such as funds, property, fixed and private equity.

Backing these offerings, Mathew has developed key risk and optimisation protocols to grow clients’ wealth while also successfully managing risk.An experienced trader, Mathew displays an extensive understanding of the market and different investment products, and he regularly produces highly detailed reports and seminars for clients.

Mathew has earned numerous licenses and certifications from The Chartered Institute of Securities and Investment, including in Securities; Investment Advice; Derivatives; Risk and Taxation; and Professional Regulation and Integrity.

Manoj Ladwa

THE REDHAT CAPITAL INVESTMENT COMMITTEE

Our Investment Committee comprises three senior trading strategists, each with distinctive specialisations in various areas. These include amongst others macro strategy, long/short trading, M&A, IPOs, investment banking, or private equity.

Members of the Redhat Investment Committee are:

- Mat Clarke, Head of Trading;

- Manoj Ladwa, Head of Futures & Options Trading Strategy;

- Aman Siddiqui, Compliance Officer and Technical Advisor.

The Redhat Investment Committee oversees and manages the investment portfolio. This ensures that the strategies deployed remain within the objective of the expected performance and returns.

- Co-founder of Redhat Capital PLC

- Over 13 years in the financial services sector

- FCA-regulated roles with CF30 accreditation

- Extensive network of international traders

- Developed key risk and optimisation protocols

- Over 20 years’ experience in the industry

- Heavy focus and specialisation across macro strategy, long/short trading, fundamentals and technical trading, special situations, M&A and IPOs

- Experienced market commentator widely quoted in the UK and international media including Bloomberg TV, CNBC, BBC and Sky Business News